I think my college graduation was one of my happiest days in life. I really worked hard to earn a degree in accounting. But then, I was worried about how I was to pay that $30,000 student loan. For sure, I was not alone in this. All graduates were worried about the debt ahead of them. However, because I hate staying in debt, I dedicated my efforts towards getting rid of it.

Throughout my entire life in college, I was involved in some part time job that involved manicures and pedicures – though I did not like it. I was lucky to secure a well-paying accountant job, but felt the amount was still little to pay off the loan ASAP. It forced me to continue with my job at the salon. It was not a friendly idea. Nevertheless, I had to do it, so I could be free from the student loan debt at the end.

I sacrificed most of my precious time, family time, and relationship time since I worked for 75 hours in a week. Thanks to the strategy – it was worth it.

Just eleven months later, I had cleared all the $30,000 debt. When my family and friend heard about my great success, they started asking for my guidance, to help them clear off their debts too.

From there, I started coaching and blogging, and my business grew exponentially. Here is what you should know about paying debts, and the mistakes people make along the way.

You Are Waiting To Earn More

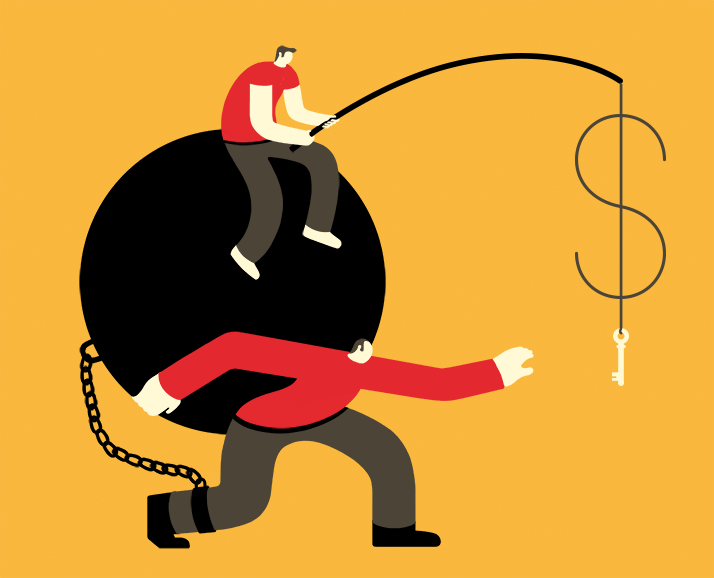

If you are not paying off your debt because you are still waiting for huge salaries, know that you are setting up yourself for future disappointments.

Life is so unpredictable. May be your company will freeze pay bump for some years, and you may be force to take a leap into entrepreneurship to start your own business from scratch. If not, you may be force to join a new career, and you will have to accept a lower paying work to acquaint yourself some new skills. In the process, your income rate may be equal to the rate of expenditure, so you do not save anything at the end.

You never know what tomorrow will bring. Do not wait for greater success when you already have enough resources to do something. Some people mistakenly think success is ahead and yet, already they are in their twilight.

Never postpone a repayment program. Use every opportunity given to repay your loan debts.

You Are Fully Dedicated To the Task

If you are reluctant about repaying your loan, you will not realize any results. Put much of your attention to the task, commit yourself, and handle it as if it is an emergency issue.

Bring your lunch to work, hire someone to help you achieve better results, and do whatever it takes to earn more. By that, you will repay whatever the debt amount within a very short period of time.

Quick Credit Pte Ltd is the best licensed money lender in Singapore. If you need help to clear all your bills or debts, let us help you. We are here to help you with anything you need. Our professional loan advisors will be able to come up with a good loan package to help you clear off all your outstanding debts.

This will help you keep track of all your bills and outstanding loans. We have been in the industry for more than 15 years. All our staff have the skills and knowledge to assist you through the entire loan process while providing you with excellent advice. We have a ton of good money lender reviews from our current and previous borrowers. Have a look online and you will be able to find out more about us 😉

Interested in knowing more about taking loans with us? You can drop us an email at enquiry@quickcredit.com.sg. We will get back to you as soon as possible. Or you can drop us a message here and our manager will get back to you soon. Alternatively you can call us at +65 6899 6188. Or visit our office at 2 Jurong East Street 21 #04-01A/B IMM Building Singapore 609601.

Let us help you solve your financial problems today. Anything that you may be facing right now, we will be able to come up with a deal just for you 🙂